At $339, Goldman Sachs is expensive. So are fine wine, quality chocolate, and life insurance for that matter. Offered, I’d turn down not one. Indeed, priced at $2 million, an Upper East Side townhouse demands a princely ransom, but might prove a lifetime bargain no less.

Overpriced and justifiably expensive part ways at the point of quality. Goldman Sachs falls firmly in the latter camp. In this first part, I’ll explore relative valuation. In the second post, I’ll turn my attention toward intrinsic value.

Price, Price-Earnings, and Price-Book

Assessing a stock in isolation can yield only limited results. For comparison, I selected 25 banks designated as ‘large’ by the Federal Reserve.

A quick glance reveals that, in raw dollar terms, GS is priced far in excess of its peer group:

When scaled, however, such a cost seems reasonable, perhaps even cheap. Goldman’s price-book ratio suggests a potential bargain if surety is a concern. One would effectively be paying a dollar to get a dollar of book value in return. Here, price-book (P/B) is calculated taking the book-value of common equity as reported in Q3 filings.

Price-earnings seems less-favourably weighted toward Goldman Sachs. The company median is closer to a figure of 11. That said, to make a formative judgement on a single year basis would be somewhat unfair.

On average, Goldman derives approximately 20% of its revenues from ‘Investment Banking’. Both 2022 and the year so-far have proven rough for capital markets. IPOs and M&A activity have made lackluster showings. The consequence of lower-than-usual earnings is a lower-than-usual denominator, and a larger-than-usual P/E. This notwithstanding, in 2022 other sources of non-interest income grew. Revenues from ‘Investment Management’, ‘Commissions and Fees’ and ‘Market Making’ were all up year-on-year. Investment Management is up in the 9 months to date.

Some of the peer group have benefitted more explicitly from a high-rate environment. Wells Fargo recorded interest income of $22 billion for the quarter ended September 2023. Driven by income on debt securities and interest accrued on loans, this is up remarkably from $14.494 billion earned in the same quarter just one year ago.

Others have benefitted from strong consumer demand. American Express has reported sizeable growth, and recently reported its sixth consecutive quarter of revenue growth.

Goldman Sachs’ earnings are tied more closely to capital markets. The potential backlog of deals promises future improvement. Analyst consensus forecasts put EPS at $34.86 for 2024:

With 342 million shares outstanding, that’s an implied Forward P/E of 9.73. This doesn’t even factor in Goldman' Sachs’ voluminous share repurchases which may drive EPS further upward.

In part II, I’ll make an effort to isolate the value of equity in GS. Even by my more conservative estimates for 2024, which put net earnings at $9.7 billion, I arrive at an estimated Forward P/E of 12.

In each case, the future looks bright, and closer to what some might denote normal.

Reliable Returns

Say what you will about Goldman Sachs, but it is undeniably reliable. Prestige is a class hard-earned. Ask around, and you’ll find few who haven’t heard the name. Longevity isn’t guaranteed. Enduring two World Wars and other such tumult, not many can trace roots to 1869.

This is a picture affirmed by analysis of peer group returns over the preceding five years. Buying Goldman Stock would have proved a positive investment, with compounded annualised growth well above the average.

To test the consistency of returns, I also looked at the coefficient of variation for each stock, taken by dividing the standard deviation of returns by the mean. This allows for comparison of otherwise-unstandardised volatility.

In each case, Goldman Sachs comes in the top three, and on these metrics is just beaten-out by MS and UBS.

That said, as far as earnings are concerned, Goldman Sachs possesses scale advantages over each. In spite of lower earnings and an inflated, P/E ratio, during the 9 months to-date, GS has offered superior EPS to UBS and MS both. Goldman reported earnings per-common share of $17.39, Morgan Stanley $4.33, and UBS $8.95, respectively for the year-to-date.

Returning to price-book ratios, one would effectively spend $1.03 for every $1 of book value at Goldman. In Morgan Stanley, an investor would have to sink $1.44.

A Cash Returning Machine?

Judging a modern company’s capital returns to investors on the basis of dividends alone would be less-than appropriate. Returns increasingly take the form of buybacks, and on this matter too, Goldman Sachs is consistent.

Again, I looked at the coefficient of variation, this time in relation to buybacks. Using data provided by Morningstar for each of the twenty-six banks, as a matter of standardisation, fairness, and consistency, I found Goldman’s coefficient of variation for buyback yield to be 0.31. The lowest of the group.

They say cash is king, and in this light, the price of GS becomes increasingly comprehensible.

The following table presents Goldman Sachs’ total cash returns to investors between 2013 and Q3 23:

Ratios are measured by dividing the respective payments by net earnings applicable to common sharedholders.

The average payout ratio (dividends alone) for the period was 21.51% per-annum.

The average modified payout ratio (dividends and buybacks) was 85.84%.

With the low coefficient of variation for buybacks, not only has Goldman returned huge swathes of capital to investors, but it has done so consistently.

Regressing Price-Book on Return on Equity

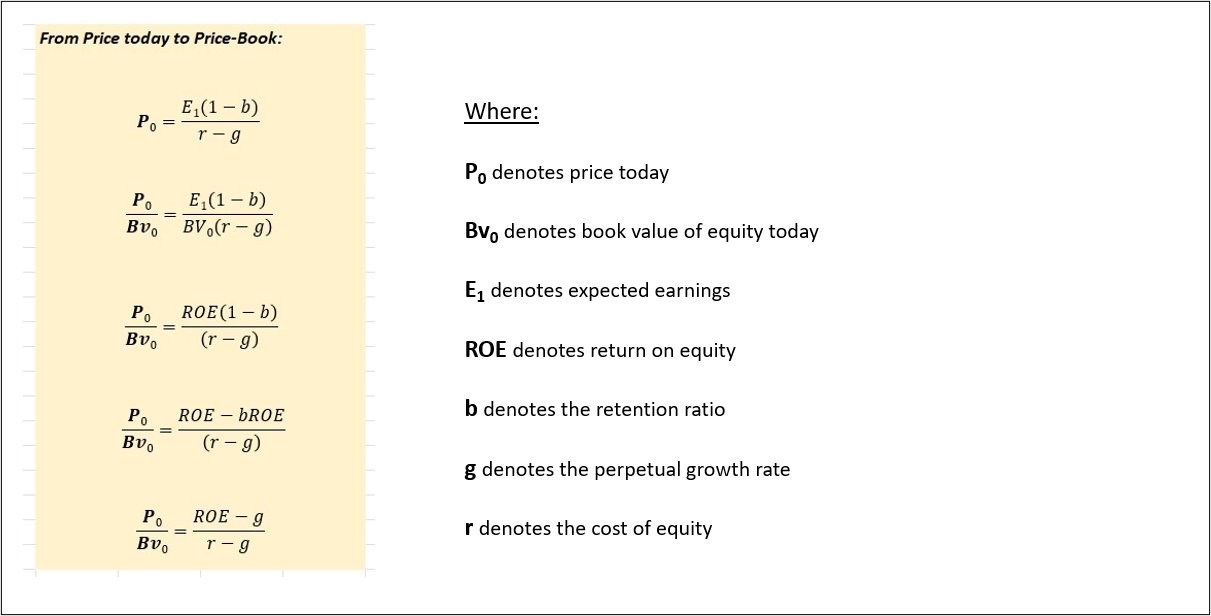

The classic constant growth model has it that price is a function of reinvestment, growth, and ROE. With some algebra and meddling, it is possible to arrive at a formulation which connects price-book and ROE:

I decided to explore this relationship further. Firstly to assess the pragmatism of the theory. If the theory holds and the market seems to price-in ROE, I wanted to see where Goldman would fall.

I regressed today’s P/B on average ROE for the preceding five years. Today’s P/B was calculated using the book value of common equity, as reported in the 26 quarterly filings for Q3 23. I fished through these myself. For average ROE, again, for the sake of consistent measurement, I used data drawn from Morningstar.

The inputs were as follows:

Visualised, the data appeared as such:

The fit seems frighteningly good. Such linear relationships are rarely without underlying cause for concern. Such that equity features in the denominator of the independent and dependent variables both, there may be a bit of forced correlation driving the relationship.

The regression also comes with a standard error of 0.329 which essentially renders the model redundant for predictive purposes at these small scales (average P/B sits between 0 and 2).

That aside, for my purpose, the model is not redundant. I wanted to get an idea of how the market is pricing financial service firms given their ROE. GS is the yellow dot, and it sits below the line.

This is to say that given how the market is pricing, Goldman Sachs might actually be cheap.

Basel, Capitalisation, and Risk

‘Basel Endgame’ has been the talk of the town lately. If you love risk-weighted assets, you’ll know it! Anyway, banks are required to maintain capital ratios as buffers against systemic risk. The global regulatory direction has been towards safety since 2008. Capital ratios have been increased, and are increasing.

Again, the picture is one of reliability. Goldman Sachs, has maintained healthy CET1 ratios throughout the preceding decade:

There seems little risk of Goldman Sachs falling below the threshold. It has managed to stay above requirements, and is unlikely to struggle as said requirements are raised.

It is worth noting that Goldman’s actual ratios, whilst comfortable, are closer to requirements than for some other banks. For investors in keen need of cash this might be taken as a good sign that the firm is balancing the need to retain capital with the desire to reward shareholders.

In summary form:

Goldman Sachs’ price-book looks quite cheap. One would essentially be paying $1 for $1 of book value.

Though price-earnings seem high, much of this owes to muted deal markets. The future looks bright, and forward price-earnings ratios are attractive.

GS has offered strong returns, near the very top of the industry group. The low coefficient of variation for these returns suggests they are reliable.

Goldman Sachs has offered bountiful capital returns to investors, with a modified payout ratio of 85.84% during the period since 2013. The coefficient of variation for these buybacks is the lowest of the data-set, again suggesting consistency.

Regressing price-book on ROE suggests the possibility that the market may actually be under-pricing GS.

Capital requirements have been maintained consistently, and regulatory needs have not crushed cash returns to common shareholders.